The Time is Now

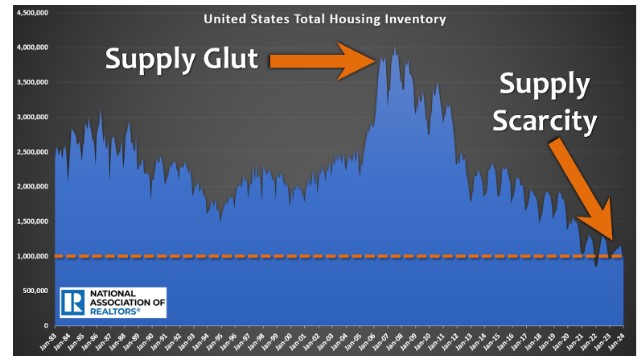

Despite mortgage rates eclipsing 7%, there are very few available homes, multiple offers are the norm, and home values are on the rise.

As the economy eventually cools, mortgage rates will drop, fueling demand and leading to an even hotter housing market.

Many potential buyers are sitting on the sidelines, waiting for the market to become more affordable. Combining high home values and significantly higher mortgage rates, the expectation was for home values to plunge. Home affordability has collapsed due to rates rising from 3.25% in January 2022 to 7% today. Purchasing a home is out of reach for so many Americans. The logic is simple: either incomes rise substantially, interest rates significantly fall, or home values tumble. They believe that the only proper solution is for home values to collapse.

Yet, the housing market has proven to be exceedingly resilient despite higher rates and low home affordability. Incomes have not suddenly spiked, mortgage rates have not plunged, and home values have risen year over year. Housing has played out much differently than expected. Buyers new to the housing arena are shocked to find tremendous competition. Jam-packed open houses, multiple offer bidding wars, and sales prices at or above the asking prices are the norm, especially in the lower price ranges.

Excerpt taken from an article by Steven Thomas.