Starter Home Squeeze

First-time home buyers are not only getting squeezed by higher mortgage rates, there are also fewer homes coming on the market in the entry-level price ranges. There is a definitive difference between starter homes and the rest of the orange county housing market.

For several years, there has been a wave of millennials turning 32, the prime first-time home buyer age. They have been getting married and having babies and now want to own a home. Unfortunately, with higher mortgage rates and higher home prices, many have been unable or unwilling to purchase. For nearly two years, since rates spiked, they have been sitting on the sidelines, waiting for either home values to plunge or mortgage rates to drop. Yet, neither has occurred. Instead, there has been a standoff between buyers and sellers, and with a limited inventory of available homes, sellers have had the edge.

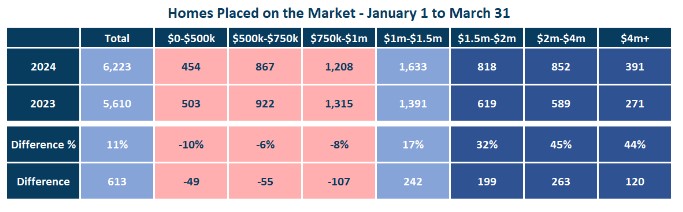

In taking a careful look under the hood, the upper ranges, anything above $1 million, has had a lot more activity than last year. There are more homes coming on the market and more closed sales. Yet, for starter homes, anything below $1 million, it is an entirely different story. There are not as many homes coming on the market, and there are far fewer closings. There is a noticeable squeeze on the starter home market.

Excerpt taken from an article by Steven Thomas.