The Stretched Dollar

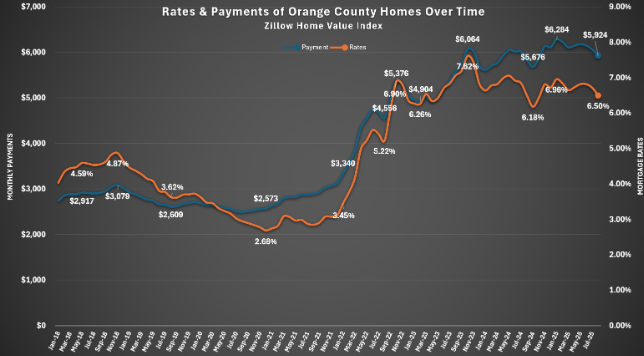

Home affordability has been at crisis levels ever since mortgage rates rocketed higher in 2022, impacting the housing market in so many ways.

Mortgage rates have been stuck at higher levels for three years now, floating between 6.5% and 7.5% with very few exceptions.

Everything is a lot more expensive compared to 2019, before the pandemic that changed the world and shut down the global economy and trade. Groceries have increased by 28%. Beef is up 52% and eggs are up 87%. The price of dining out at a restaurant is up 32%. New cars are up by 20%, and used cars jumped by 31%. Everyone’s wallets have been stretched.

Nothing was hit harder than housing. Monthly rents have increased by 29% nationwide, and home values soared 51%. Household incomes in California have only increased by 15% since 2019. In looking at home affordability, it is critical to look at home prices, household incomes, and the prevailing mortgage rate. The gap between the rise in home prices and incomes explains why housing affordability quickly became an issue as the pandemic wore on. Then in 2022, mortgage rates rocketed from 3.25% in January to 7.37% in October. Home affordability was squeezed. Not only did prices surge, but the jump in rates created a crisis in home affordability.

Excerpt taken from an article by Steven Thomas.