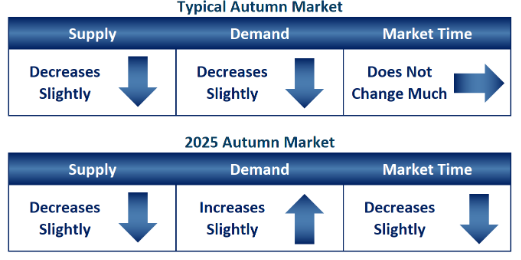

The Fall Market Takes a Turn

The lowest mortgage rates of the year are paving the way for a much different Fall Market with a falling inventory, increasing demand, and declining market times.

Rates have slowly made their way from just over 7% for the first couple of months of the year to nearly 6.25% today, paving the way for a bump in buyer demand.

Anyone who has taken up running knows that initially it is hard to run that far. A great strategy is to simply run a mile consistently for a couple of weeks, and then slowly ramp up the mileage. Going from a mile to a mile-and-a-half, from a mile-and-a half to two miles, and then from two miles to three miles over the course of many weeks allows the body to adjust to the increasing demands of longer distance workouts. The consistency and slow progression build endurance, allowing a novice runner to run farther and farther distances. This approach is not instant; it does not happen overnight. Instead, over time, the new runner slowly improves.

Mortgage rates have reached their lowest level of the year, nearly 6.25%. It too did not happen overnight. They started the year at just above 7% and eclipsed 7.25% in mid-January. Mortgage rates tend to fluctuate from week to week, yet the trend has been for rates to improve slowly from month to month. They have been consistently below 7% since the end of May. They dropped below 6.75% at the start of August, and then dropped below 6.5% at the beginning of September. With weaker job numbers, they have settled close to 6.25%. Over time, mortgage rates have slowly improved.

Excerpt taken from an article by Steven Thomas.