Housing Haunted by the Fed

As the Federal Reserve pushed harder and harder on the economic brake pedal by increasing the Fed Funds Rate at the fastest pace in recent history, the housing market has slowed to a crawl.

In June the Federal Reserve announced that they had plans to “reset” the U.S. housing market, and that is precisely what is occurring today.

All year long the Federal Reserve has been in the news. Inflation had become enemy number one and they were going to do everything in their power to tamp down out-of-control inflation. Prices of goods, services, food, and energy were climbing at an unhealthy rate. Home values had soared by over 40% in just two years.

Jerome Powell, chair of the Federal Reserve Board, delivered speeches in December of last year, March, June, August, and September of this year, and with each speech the tone increasingly became more vigilant. At first, the carefully telegraphed message seemingly tiptoed around how far they were going to go to fight inflation, but by September, they seemingly were brandishing swords and shields, ready to go to battle.

In June, after delivering his prepared press conference remarks, Jerome Powell was asked about their outlook for the housing market. He stated that housing needed “a bit of a reset.” During the September press conference, a reporter asked for him to elaborate on what he meant by a housing “reset.” He did just that:

- An end to the swift rise in home prices where homes were selling way over their asking prices.

- For supply and demand to get better aligned so that home values did not skyrocket higher.

- Help bring home prices more in line with rents and other housing fundamentals.

- The housing market would have to go through a correction to get to that place, a better balance.

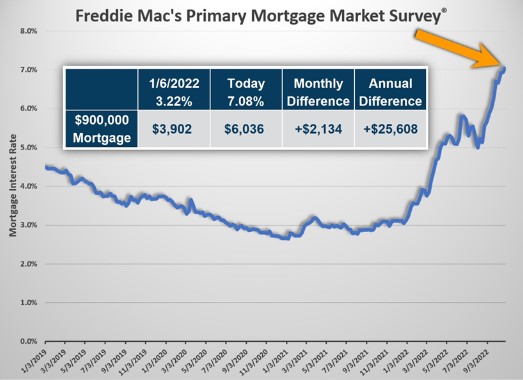

In economic terms, a correction typically means that home values drop between 10% to 20% from the peak. That peak occurred in May and prices have been on the decline in Southern California ever since. The issue is that mortgage rates have climbed at an unprecedented pace this year in response to all the Fed’s actions and statements, climbing from 3.22% at the start of January to 7.08% today, according to Freddie Mac’s Primary Mortgage Market Survey®. In the over 51 years in conducting the survey, mortgage rates have never climbed this much in a year, surpassing the prior record annual gain in 1981.

Excerpt taken from an article by Steven Thomas.