Housing Experts Report on the New Normal

Using a MarketNsight study of 18 cities across the country, Builder Magazine’s John Hunt explores how, in spite of nearly a decade of positive job growth and population growth, the U.S. housing market is still anywhere from 30% to 60% below pre-recession levels.

In the “old normal” (before the 2003 to 2006 bubble), Hunt says first-time buyers and first-move-up buyers made up 60% of all new home sales. Buyers typically entered the market for the first time by the age of 25, started a family, and moved to larger homes around age 32. Currently, however, that demographic accounts for less than 40% of new home sales. The profile of today’s first-time buyer reveals an average age of 33-years-old, with this aging trend not changing any time soon.

“There have been countless articles written about millennials’ absence from the new home market,” says Hunt. “It comes down to this – we cannot give them what they want, where they want it, at a price they can afford… yet. We are in the very early stages of seeing some much-needed innovation in our industry, aimed at recapturing a small percentage of that all-important first-time buyer.”

Hunt uses the retail sector as an example of how desperately innovation is needed. He talks of a reset in that all-important industry, with thousands of brick and mortar locations closing last year with that pace now quickening. “Changes in shopping habits, driven by technology and millennials, have caught many traditional retailers unprepared. We would do well to take note of this in our industry,” says Hunt.

Anyone in the housing industry who was around back in the late ‘90s and early 2000s may recall how slow builders were slow to embrace using the Internet, instead paying for huge display ads in local newspapers, which were, in general, already going the way of the dodo. Hunt says the housing industry has been slow to innovate, essentially building the same house today that it built 40 years ago. “Our last major innovation was also brought about by a technological revolution – the sewer. As sewer lines reached farther out from city centers, we saw the 1950s and 1960s brick ranches on a half-acre give way to the five, four-and-a-door homes of the 1980s…and there we stopped. We did not innovate from 2000 to 2006 because there was no need.” After that? Well, we know what that market looked like.

Hunt recalls truly believing that the apartment industry was going to over-build beginning 3 or 4 years ago, citing rising rental rates that would beckon renters to become homeowners. But now he says he and other experts were all wrong. “The old rules in housing simply do not apply anymore,” he says. “A quick check of the rental rates and square footages in your core counties might surprise you.”

Today’s first time home buyers, as well as other demographics of buyers, are willing to pay high prices for much smaller spaces in their preferred locations and Hunt says some pioneering builders and developers are taking notice of this and choosing to compete.

This means condos and townhomes, located where buyers want to live, are gaining in popularity so fast that no one seems to care about the common-wall-air-space-monthly-fees thing anymore. Also thrown into this mix are tiny homes within good commute distances to metro areas.

MarketNsight’s study reveals millennials are not alone, with Baby Boomers vying for the same homes in a market when housing is already tight. With kids are gone and retirement imminent, young-at-heart older buyers prefer to leave the suburbs behind and move to where the action is. All this means is that experiences and location are the new rock stars of housing, with square footage rapidly becoming the poor stepchild.

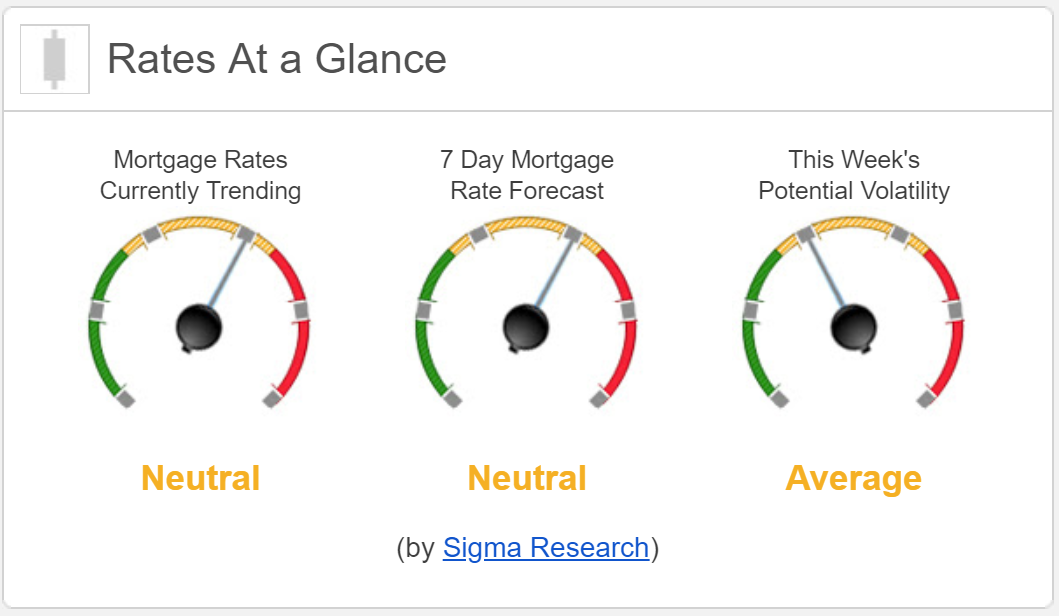

Rates Currently Trending: Neutral

Mortgage rates are trending sideways this morning. Last week the MBS market improved by +12bps. This was not enough to significantly improve rates last week. Mortgage rates stayed in a very tight channel throughout the week.