Investors are buying up a record number of homes

According to data release by CoreLogic, big private-equity firms, real-estate speculators and others that buy properties comprised more than 11% of U.S. home purchasers in 2018.

What does this mean? It means that with investor purchases of U.S. homes at an all-time high, rising home prices have done little to dampen demand for flipping homes or turning them into single-family rentals. The investor purchases are near twice the levels before the 2008 housing crash. While this can pose a challenge for millennials and other first-time buyers who are increasingly looking to buy starter homes but are forced to compete with deep-pocketed cash buyers, it also means demand is still high, and real estate remains healthy.

“Big commercial property owners like Blackstone Group LP and Starwood Capital Group began buying thousands of homes out of foreclosure during the housing bust,” says realtor.com’s Laura Kusisto. “Many economists credit investors with helping to stabilize the housing market in 2011 and 2012 by buying with cash when prices were low and mortgage credit froze.”

But, she adds, analysts expected those purchases to slow as the market rebounded and properties could no longer be had for bargains. The reverse happened, and demand for properties has intensified. “While these purchases dipped slightly when the market started to recover in 2015 and 2016, they have rebounded to surpass the previous peak of six years ago,” says Kusisto.

She explains how investors are an especially powerful force at the bottom of the market, where all-cash deals often dwell. CoreLogic discovered that investors purchased one in five homes in the bottom third price range in 2018, up 5 percentage points from the 20-year average of less than 15% — homes that first-time home buyers would logically be buying.

This isn’t happening everywhere, however. “The biggest markets for investor purchases in 2018 were Detroit, followed by Philadelphia and Memphis, Tenn., where home prices are still low enough for investors to profit by renting them out,” says Kusisto.

Source: Realtor, CoreLogic, TBWS

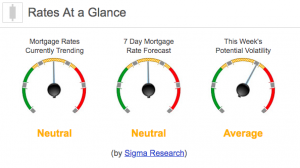

Rates Currently Trending: Neutral

Mortgage rates are trending sideways so far today. Last week the MBS market improved by +2bps. This caused rates to move sideways on relatively low volatility.