Existing home sales rebound in February

Homes with experience are selling better than expected these days. According to the National Association of Realtors (NAR), sales of previously owned homes rose sharply in February, a sign that demand for housing picked up as mortgage rates eased last month.

According to the report there was an 11.8% increase in February from the prior month to a seasonally adjusted annual rate of 5.51 million, according to the report, while economists surveyed by The Wall Street Journal had expected sales to rise only 3.2% to a rate of 5.1 million in February.

The NAR said there were 1.63 million existing homes available for sale at the end of February, up to 3.2% from a year earlier and representing a 3.5-month supply at the current sales pace, and its chief economist, Lawrence Yun, said the latest data represent a “powerful recovery” in existing home sales. He credits it to lower interest rates and increased inventory. The strong labor market and wage growth are also contributors.

This represents the strongest percentage increase since December 2015, according to Yun. And this data indicated housing could be poised to recover this spring after starting the first quarter on less than even ground.

The national median sale price for a previously owned home last month was $249,500, up 3.6% from a year earlier. While sales in the Northeast were flat, but in the Midwest they rose by 9.5% in the Midwest. Out West sales rose 16% in February from January. The South saw sales rise by 14.9% from January.

Source: Realtor, TBWS

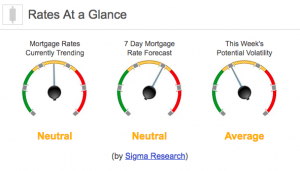

Rates Currently Trending: Neutral

Mortgage rates are trending sideways this morning. Last week the MBS market improved by +50bps. This was enough to move rates lower last week. We saw high rate volatility throughout the week.