Mortgage Rates have seen solid improvements this week as investors shift focus to recession fears in 2023. Change has been in the air since the November 10th CPI data came out. That report did MORE than ANY other event to change the rising interest rate narrative. Then, 2 days ago, Fed Bar Powell confirmed the Fed is now at the point of SLOWING THE PACE of rate hikes and is settling in on a “terminal” rate cap or ceiling. In order for this narrative to continue, not only does inflation need to moderate, but the labor market cannot send strong signals.

Today, nonfarm payrolls increased 263,000 in November, much BIGGER than the 200,000 increase expected by economists polled by Dow Jones. The unemployment rate held steady at 3.7%. Average hourly earnings also came in above expectations, jumping 0.6% compared with the prior month and 5.1% against the same month a year ago.

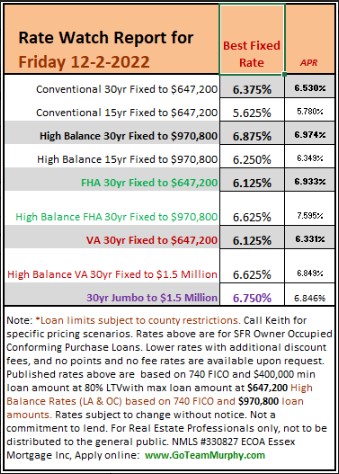

Bottom Line: the mortgage rate are moving higher this morning. Since we had a big rally and now reversing trend, my belief is to lock in the short term, but float if you are not closing for 30 days.

SOURCE & AUTHOR |

Keith Murphy Branch Manager – Essex Mortgage NMLS #330827

Direct: 714-309-1140

Apply: www.GoTeamMurphy.com