Mortgage Rates are slightly higher, but BIGGER volatility is on the way! The mortgage rates (the bond markets) have been remarkably well behaved since the November 10th release of the last Consumer Price Index (CPI), the monthly inflation report that has the biggest impact on the market.

All of that changes next week, or at least it has the most potential to change next week (hence BIGGER volatility). The CPI report comes out on Tuesday. If that’s not enough to cause an extreme reaction in the bond market, the Fed announcement is out on Wednesday and it can also pack a punch!

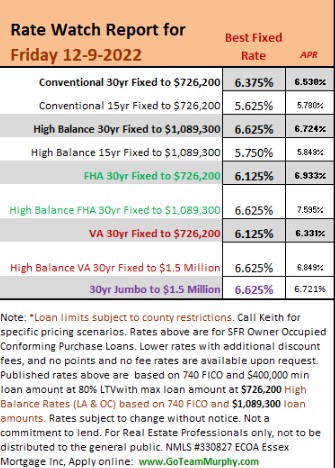

Bottom Line: Between now and then, while there are never any guarantees about the future when it comes to financial markets, rates aren’t likely to be anywhere other than the mid-to-low 6% range for top tier Conventional 30yr fixed scenarios.

SOURCE & AUTHOR |

Keith Murphy Branch Manager – Essex Mortgage NMLS #330827

Direct: 714-309-1140

Apply: www.GoTeamMurphy.com