Mortgage Rates: A Slight Dip

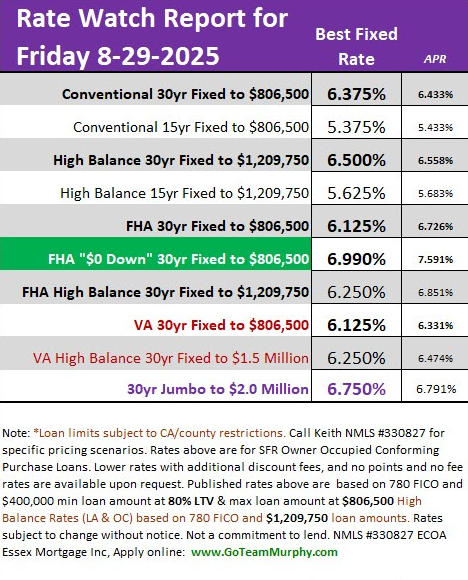

Mortgage Rates are still trending slightly lower this week with average 30-year fixed mortgage rate has decreased to 6.375%, down from 6.50% the previous week. (Note: this is for top-tier borrowers of conforming purchase loans, with 20% down, and 780 FICO scores) This marks the lowest point since April, offering a modest reprieve for prospective homebuyers.

The Role of Mortgage-Backed Securities (MBS)

Mortgage rates are closely tied to the performance of Mortgage-Backed Securities (MBS). When MBS prices rise, yields fall, leading to lower mortgage rates. This week, MBS prices have seen slight increases, contributing to the dip in mortgage rates.

Federal Reserve Policies and Economic Indicators

The Federal Reserve's stance on interest rates significantly impacts mortgage rates. Fed Governor Christopher Waller has indicated support for initiating interest rate cuts starting in September, citing signs of a weakening labor market. Such policy shifts can lead to lower mortgage rates as borrowing costs decrease.

Supply and Demand Dynamics

Mortgage applications have decreased by 0.5% in the week ending August 22, 2025, indicating a slight dip in demand. This reduction in demand can exert downward pressure on mortgage rates as lenders adjust to attract borrowers.

Bottom Line: While the recent dip in mortgage rates is encouraging, the market remains sensitive to economic indicators and Federal Reserve policies. Prospective home buyers should stay informed about these factors, as they can influence borrowing costs in the coming weeks.

SOURCE & AUTHOR | Keith Murphy Branch Manager – Essex Mortgage NMLS #330827 Direct: 714-309-1140 Apply: www.GoTeamMurphy.com