Propelled by record low mortgage rates, buyers are jumping back into the housing market.

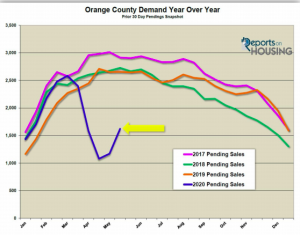

Demand Spikes: Demand surged in the past couple of weeks with a 38% rise.

COVID-19 has impacted the economy across the board. The economic data prior to the Coronavirus was pumping on all cylinders. Consumer confidence, consumption, unemployment, housing, stocks, leading economic indicators, everything was pointing to a phenomenal 2020. After the virus broke, every chart was impacted severely. Housing was no exception. Experts have been debating what the economic recovery will look like. Initially, some experts were calling for a quick rebound, a “V-Shaped” bounce. That is when the economy rises nearly as fast as it falls. Yet, with more time to reflect on all the data, most experts now agree that it will be a “U-Shaped” recovery, one that after hitting a bottom will slowly but surely turn upward. The best analogy is a dimmer switch. As the dial is slowly turned, the economy will continue to accelerate until one day it is pumping on all cylinders again. Housing is proving that it is an exception and is currently experiencing a “V-Shaped” recovery with demand soaring 38% in the past two weeks. How can that be? The sleeping giant has awakened. Even though life as everybody knows it has been turned upside down and California has only moved to “Phase 2,” record low interest rates are instigating demand. Dawning masks and gloves, buyers are viewing homes again and making offers. Prior to the “stay at home” order in mid-March, housing was a sizzling hot Seller’s Market with extraordinarily little inventory and unbelievable demand. It was the hottest start to a Spring Market since 2013, a spring to remember for Orange County housing. Low mortgage rates, averaging 3.75%, was stoking the fires of demand. When the virus hit, demand plunged, and the market slowed.